Your Money and the State: How Fiscal Policies Shape Personal Wealth

Chosen theme: Fiscal Policies: How They Impact Personal Wealth. Explore how taxes, spending, deficits, and subsidies flow through paychecks, prices, investments, and daily choices—so you can respond confidently, grow stability, and turn policy shifts into personal opportunity.

Taxes as the Front Door of Fiscal Policy

Income Taxes and the Paycheck Ripple

Income tax brackets, withholding choices, and employer benefits determine how much of your salary becomes investable wealth each month. Small adjustments—like optimizing withholding or leveraging pre-tax benefits—can meaningfully change cash flow. Share your approach and compare notes with readers navigating similar thresholds.

Sales, VAT, and What Everyday Receipts Reveal

Consumption taxes shape what you keep after every purchase. When rates rise, the impact feels immediate at the checkout, nudging behavior toward discounted periods or durable goods. Track a week of receipts, notice patterns, and post your findings to help others spot invisible leaks.

Borrowing Today, Obligations Tomorrow

Deficits can stabilize recessions but also expand future interest costs. For households, that means planning for possible tax changes or slower benefit growth later. How do you balance long-term caution with today’s opportunities? Share your framework for thinking across economic cycles.

Bonds, Yields, and Mortgage Math

When government borrowing rises, yields can drift upward, shaping mortgage rates and bond returns. Refinancing windows may narrow. Savers might ladder maturities for flexibility. Describe your rate strategy—fixed or variable—and how fiscal headlines influence your timeline to buy, refinance, or hold.

When Fiscal and Monetary Policy Dance

Fiscal spending and central bank decisions interact in real time. Stimulus may lift demand; tighter money may cool inflation. Your job is translating the duet into choices: cash buffers, debt paydown, or asset rebalancing. Subscribe for timely breakdowns of policy moves into practical next steps.

Inflation, Subsidies, and Real Purchasing Power

Targeted Subsidies: Relief with Side Effects

Energy or transport subsidies can lower monthly bills, freeing cash for savings or debt reduction. Yet broad subsidies sometimes nudge demand higher. Map your essential costs, apply eligible programs, and report which relief made the biggest difference in your monthly breathing room.

Tax Credits You Should Not Miss

Childcare credits, education incentives, and energy-efficiency credits often go unclaimed. Keep a checklist tied to life events and big purchases. If a credit helps you invest sooner or pay debt faster, tell readers how you discovered it, and help someone avoid missing out.

Inflation Expectations and Household Decisions

What you expect about future prices influences today’s choices—fixed-rate loans, inventory for a small business, or buying durable goods. Calm, data-informed expectations prevent costly overreactions. Comment with your simple metric—like a shopping basket—to track real-life inflation you actually feel.

Budgets, Elections, and the Policy Clock

Budget Season: Reading the Fine Print

Proposals telegraph priorities: tax thresholds, benefits, and spending shifts. Build a habit of skimming summaries from credible sources. Create an annual checklist to adjust withholding, contributions, and savings goals. Share your favorite public resource for understanding budget changes quickly and accurately.

Sunsets, Phase-Ins, and Why Timing Matters

Many tax cuts expire and credits phase in slowly. Plan purchases or contributions around scheduled changes to maximize benefits. Have you ever timed a big expense to align with a policy window? Post your story so others can learn from your timing strategy.

Midyear Adjustments and Surprises

Supplemental budgets and emergency measures can appear fast. A flexible plan—with cash reserves and adjustable goals—keeps you steady. Subscribe to get concise alerts translating sudden announcements into step-by-step actions you can take within days, not months.

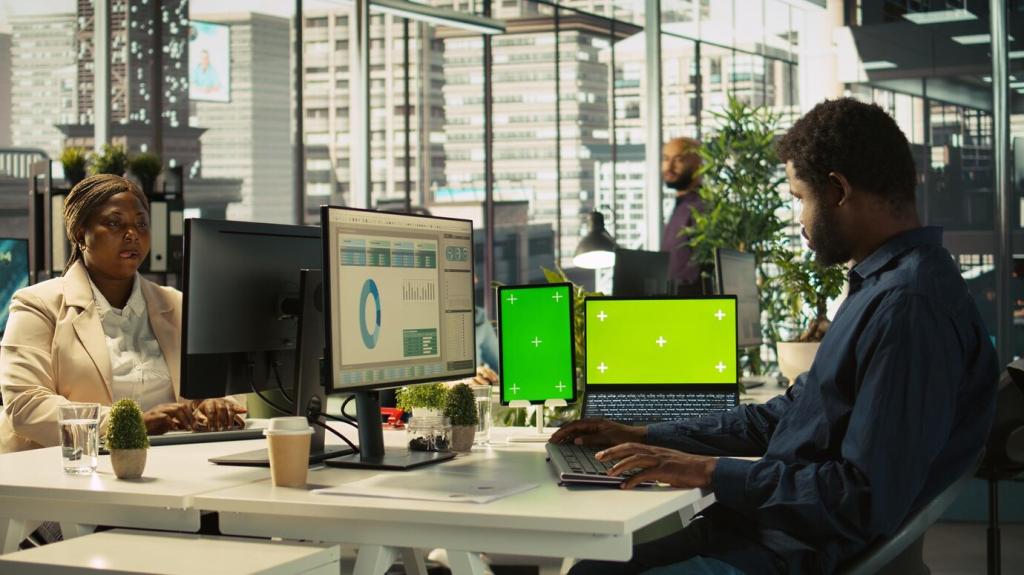

Case Studies: Households Under Changing Fiscal Winds

A modest raise nudged Maya into a higher bracket. She increased retirement contributions to manage taxes, refinanced her student loan, and used a tuition credit to fund a certificate. Her takeaway: combine tax-advantaged saving with skills that raise long-term earning power.

Case Studies: Households Under Changing Fiscal Winds

Post-stimulus demand lifted orders but tightened labor markets. Luis claimed an equipment deduction, built a three-month cash buffer, and secured a fixed-rate loan before rates climbed. He now updates prices quarterly and shares a transparent note with customers about cost drivers.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.